Calculate payroll taxes 2023

Web For example based on. Web 2022 Federal income tax withholding calculation.

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download

This calculator is meant to help you.

. Sign up for a free Taxpert account and e-file your returns each year they are due. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Web For 2022-23 the rate of payroll tax for regional Victorian employers is 12125.

Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Web Begin tax planning using the 2023 Return Calculator below.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Easily Approve Automated Matching Suggestions or Make Changes and Additions.

Web Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. This Tax Calculator will be updated during 2022 and 2023 as.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Compare This Years Top 5 Free Payroll Software. There is also a special payroll tax rate for businesses in bushfire affected local.

Calculate your state local and federal taxes with our free. 2022 Federal income tax withholding. Free Unbiased Reviews Top Picks.

Web SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. The Citys payroll system is based on the fiscal year covering the period July 1 through June. 20202021 2022 and 2023.

Ad Join Other Business Owners Whove Made Their Payroll Management Easier. All Services Backed by Tax Guarantee. Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Web Cash Payrolls Luxury Tax Payrolls. Tax Table for 20222023 Bands. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Prepare and e-File your. Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments.

Get a head start on your next return. This Tax Calculator will be updated during. Ad Compare This Years Top 5 Free Payroll Software.

Web For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of. Use the Payroll Deductions Online. The highest tax bracket is 6 while.

For example if an employee earns 1500. Web 2022 Federal income tax withholding calculation. Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Web The payroll tax rate reverted to 545 on 1 July 2022. Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Web The payroll tax rate reverted to 545 on 1 July 2022.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Unbiased Reviews Top Picks. 2023 Payroll Deduction Calculator.

Starting as Low as 6Month. All Services Backed by Tax Guarantee. Start the TAXstimator Then select your IRS Tax Return Filing Status.

See where that hard-earned money goes - with UK income tax National. Web The wage base for Medicare has no limit so both you and your employee are liable for 145 taxes on everything earned including the value of any non-cash benefits. Multiply taxable gross wages by the.

Web Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Subtract 12900 for Married otherwise. Web This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

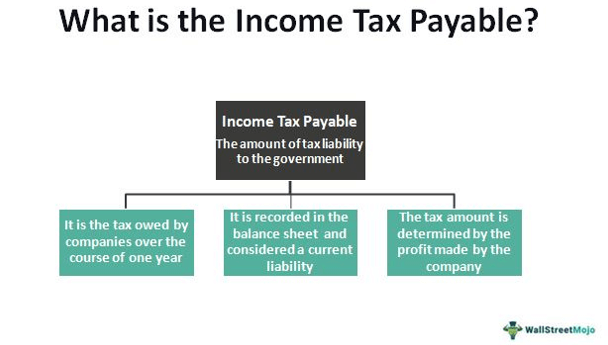

Income Tax Payable Definition Formula Example Calculation

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Processing The Year End

China Guide Withholding Tax In China Asia Briefing Country Guide Portal

Basic Guide To Calculate Your Income Tax Liability

Between Dates Income Calculator Gross Wages And Work Stats

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Income Statement 2019 2020 2021 2022 2023 2024 Sales Chegg Com

Tds Rate Chart For Fy 2022 23 Ay 2023 2024 Razorpayx

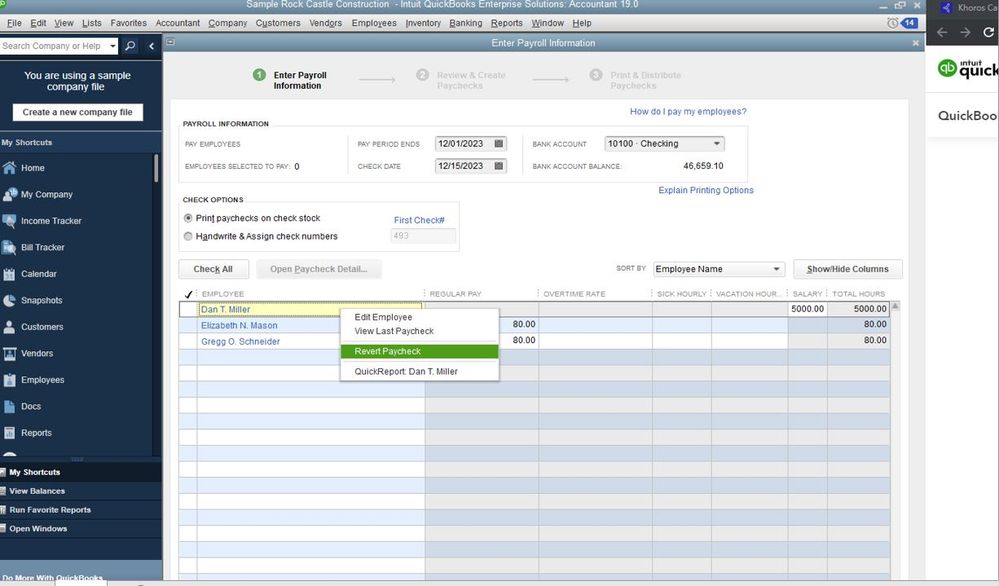

Solved Other Payroll Items Not Calculating User Defined Payroll Item

2

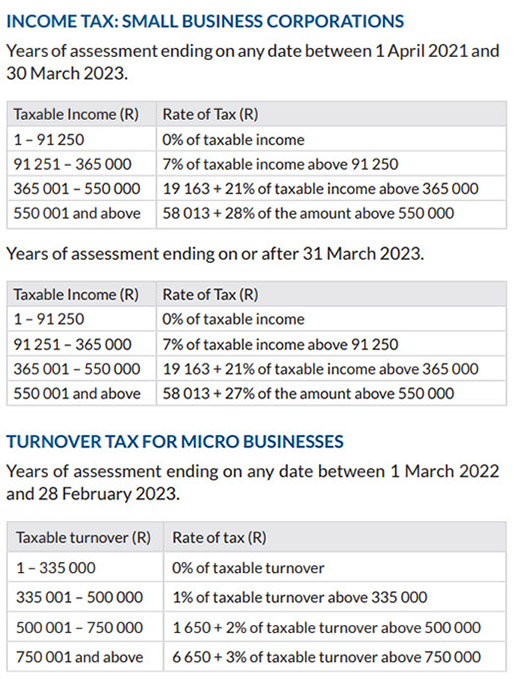

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Current Income Tax Rates For Fy 2021 22 Ay 2022 23 Sag Infotech

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download

Solved Payroll Tax Updates Not Working

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Pre Tax Vs Post Tax Valuations Modano